Achieving Carbon Negative on a Global Scale

We invest in breakthrough negative emission solutions to solve the most pressing climate problems within this generation.

about

The Fund

CarbonN Venture Partners is a venture capital firm based in Silicon Valley. Led by two seasoned deep-tech investors with a singular focus to reverse the effects of climate change – accelerating the commercialization and scale-up of breakthrough technologies toward a negative emission economy.

We invest in startups Seed / Pre-Series A stage, with initial ticket sizes ranging between $250K and $1M. We will selectively deploy follow-on capital to fund First-of-a-Kind (FOAK) projects through project equity or term loans.

As part of our investment mandate, we assess a startup’s climate impact potential in an analytical and quantifiable way, e.g. Mt CO2e removed, Mt of waste prevented. We will work closely with our portfolio companies to measure and report their own ESG and impact metrics.

investment

Thesis

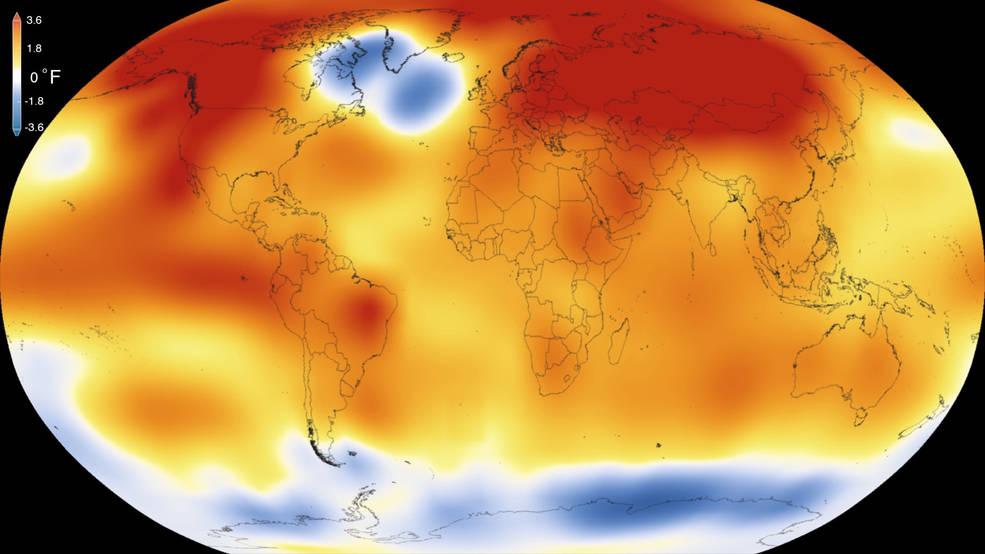

Climate disasters like floods, wildfires, snowstorms and droughts are paralyzing supply chains, industries and societies. The sense of urgency as a whole is still not there…

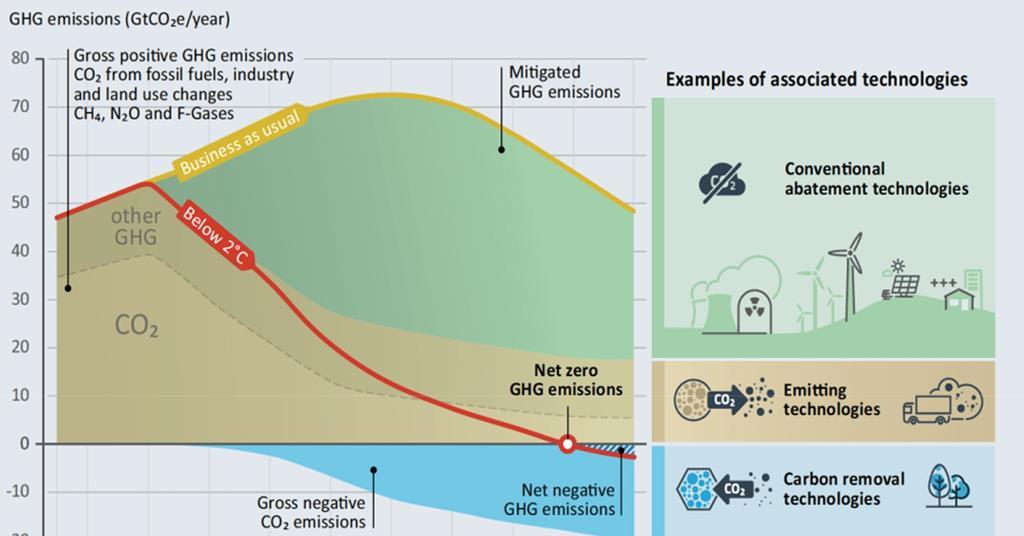

To limit global warming to below 2C, carbon reduction technologies are necessary to lower “future” emissions, while carbon removal technologies are needed to lower “historical” CO2 from the environment. These solutions together need to reach gigaton-levels within the next 3 decades.

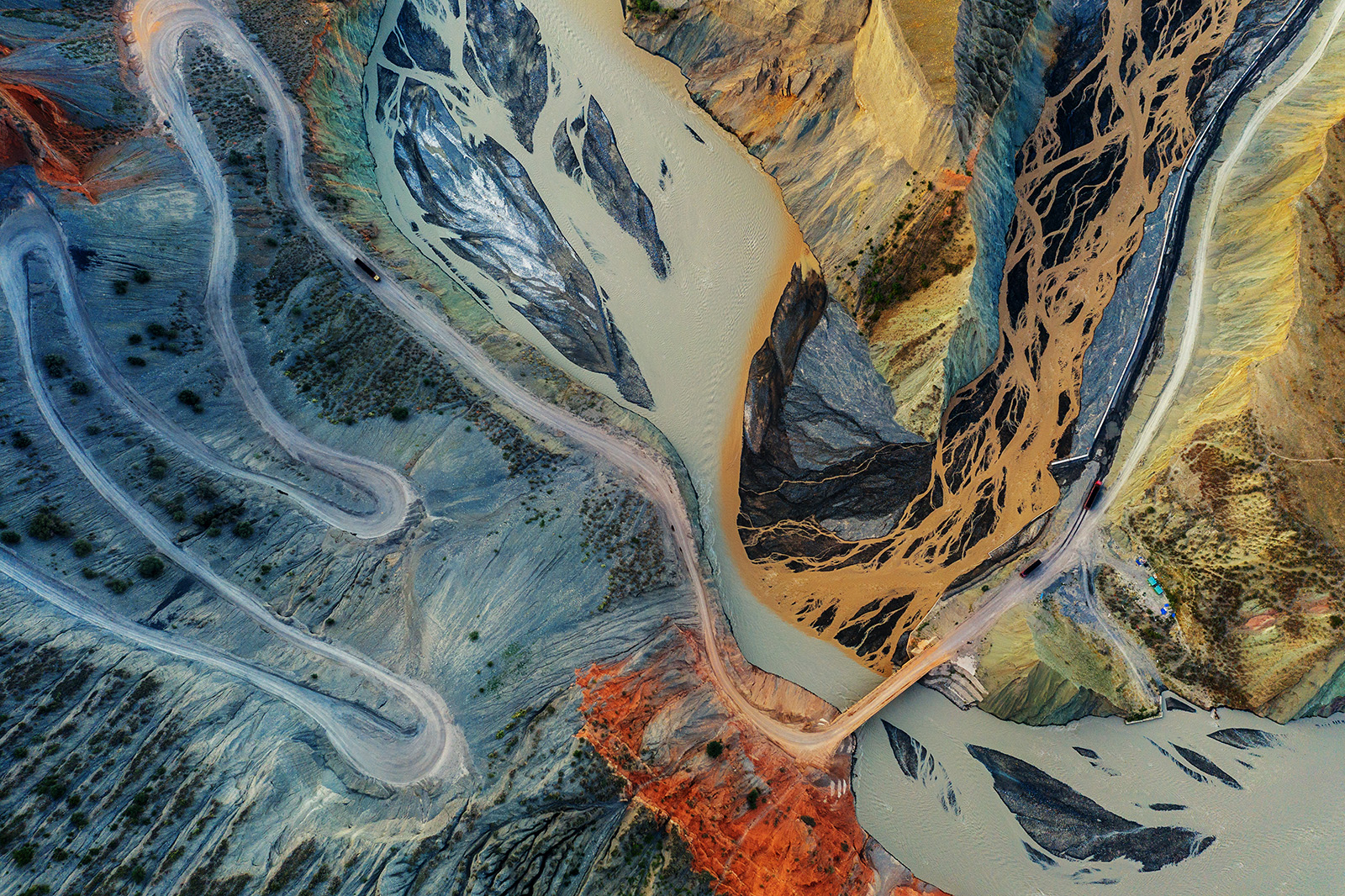

To accelerate and sustain the transition of clean energy, innovations in the critical minerals supply chain such as energy efficient extraction, refining and recycling processes, applied AI and robotics, as well as disruptive carbon-backed financing products and business models must scale up to make a meaningful impact.

We believe that investing in these opportunities will deliver venture-scale outsized return while bringing significant social and environmental ROI.

(Diagram: ChemistryWorld)

global GHG emissions in GtCO2e per year today

CO2 concentration in ppm today in the atmosphere

GtCO2e per year removal required by 2050

FOcUs

Investment Areas

We invest across a portfolio of deep tech solutions augmented and catalyzed by Data and Finance innovations – Critical Minerals Sustainability, Industrial Decarbonization, and Climate Resilience.

Industrial Decarbonization

Carbon Capture, Utilization and Storage (CCUS), CDR, Waste Heat Recovery, Green Steel, Zero-Carbon Cement

Climate Resilience

Wildfire Early-Warning & Detection, Regenerative Agriculture, Carbon Accounting, Sustainable Finance, Digital MRV

Critical Minerals Sustainability

Extraction, Refining and Recycling Tech – Battery, E-waste, Tailings, Solar, Wind; Applied AI and robotics

Climate catastrophes like floods, wildfires, snowstorms and droughts are paralyzing supply chains, industries and societies. The sense of urgency as a whole is still not there…

We believe identifying opportunities with significant social and environmental impacts will lead to better financial return.

CAtalytic

Capital

Source: xxxx

IMPACt

Responsible Investing

Better Climate Performance Leads to Better Financial Returns

We are committed to responsible investment and incorporating specific ESG considerations into our investment process. We seek to help our portfolio companies to mitigate and manage risk as well as their long-term sustainability. We believe integrating these ESG principles in our investment practice will have a positive impact on the financial performance of our fund. See our ESG Policy for details.

Contact

Info

CarbonN Venture Partners is headquartered in

Silicon Valley, California.

Stay In Touch

Get unparalleled access to new opportunities and markets focusing on decarbonization and sustainability. Subscribe to our newsletter.